Insurance Appeals and Denials

A part of utilizing insurance benefits to cover autism treatments is knowing a treatment request could be denied. Sometimes, the insurance carrier (insurer) may not be aware of research articles that could back up your request or understand ASD has rights under the federal parity law. Appeals are not easy and most initial appeals are not won by consumers but do not get discouraged. Let’s use these opportunities to educate the insurer and build support for ASD treatments being medically necessary.

A Denial is called an ‘Adverse Benefit Determination’ meaning:

- Any reduction in benefits

- Partial approval of benefits – ex. approval for 15 hours when asked for 22 hours, these denials are hard to get in writing

- Termination of benefits

- Failure to pay providers or reimburse consumers, including incorrect copay, coinsurance or deductible calculations

- Rescission (retroactive cancellation) of coverage

- Any decision that leaves you with an uncovered cost, or denies access to care

- Restricting to certain environments

Two Types of Notifications you may receive telling you a Denial Has Occurred

Common Denials from Insurance Carriers for ABA and Points to Share at your Appeal or Hearing

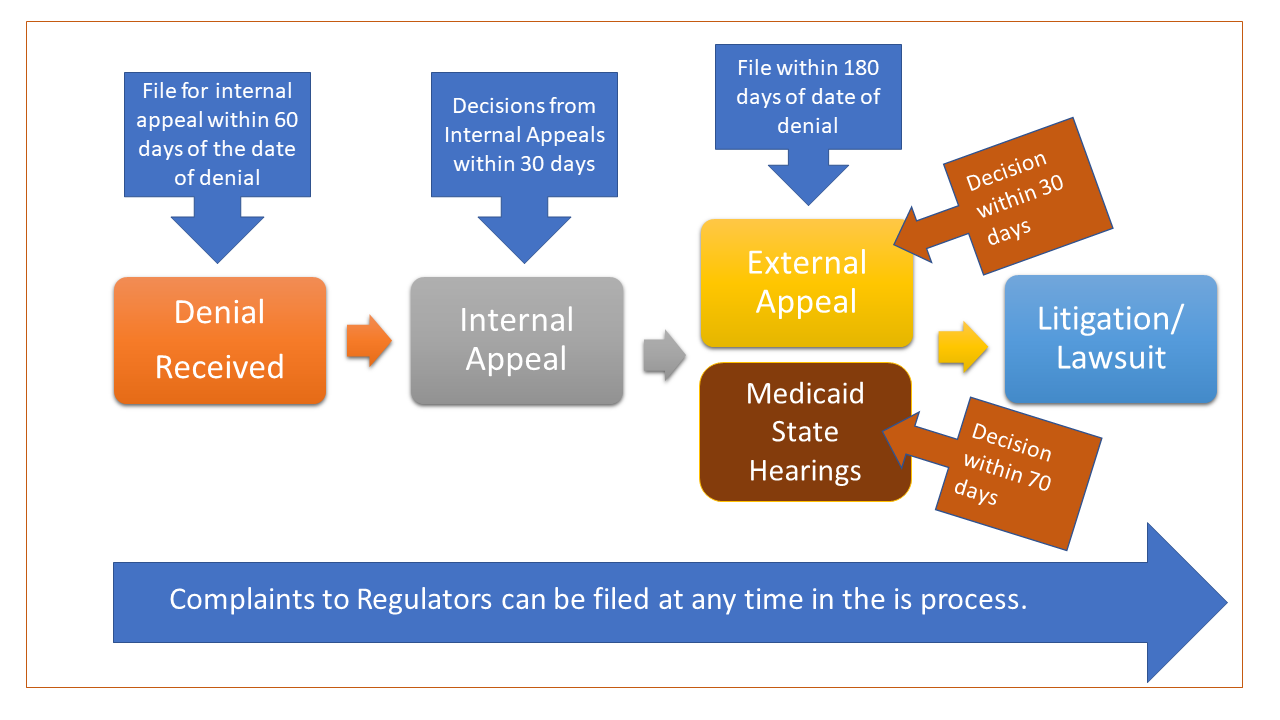

Insurance Denials & Appeal Process

After receiving a denial, follow the following Appeals Process

-

- Speak with your employer’s HR department and/or consider requesting a care manager with the insurer to see if you can resolve the issue.

- Read the link above for common denials in ABA for talking points.

- File an internal appeal if you are not satisfied and still being denied.

-

- Internal appeals are often denied, but you have to do that step first, so don’t get discouraged.

- Try to follow the rules, deadlines and provide good documentation to be successful in the appeals process. Good Documentation for Appeals

- Employer-sponsored, Exchange and Individual Market plans

- Utilizes internal, external and expedited appeals. Follow this easy to read chart to learn more

- Review your health plans benefit manual for the appeal process

-

- File an external appeal if you lose the internal appeal

- External review appeals are consumer’s best chance for a fair hearing by an objective independent medical professional.

- Employer-sponsored, Exchange and Individual Market plans

- Link to learn more about external appeals

- Consider filing a Complaint with the Regulatory Government Agency if you are having challenges working through the appeal process.

- Fully-Insured Employer Plans and Exchange plans

- Self-Funded Insured ERISA Employer Plans = U.S. Department of Labor (DOL)

- Contacting DOL for questions or concerns you may have.

- Chicago office for northern Illinois residents (312-353-0900),

- Kansas City Office for southern Illinois (816-285-1800) or

- https://www.dol.gov/agencies/ebsa/about-ebsa/ask-a-question/ask-ebsa

- ERISA DOL Mental Health Parity and Substance Abuse Benefits

- Contacting DOL for questions or concerns you may have.

- Consider filing for Litigation/Lawsuit if you lose the external appeal,

- Litigation would be for extreme cases

- This is a very expensive process

- Consider filing before losing an external appeal, the court views the external review organization (ERO) as the expert.

- Speak with your employer’s HR department and/or consider requesting a care manager with the insurer to see if you can resolve the issue.